In applying our model to explore why Google Glass failed, we found something surprising: Glass didn’t just die. Google killed it.

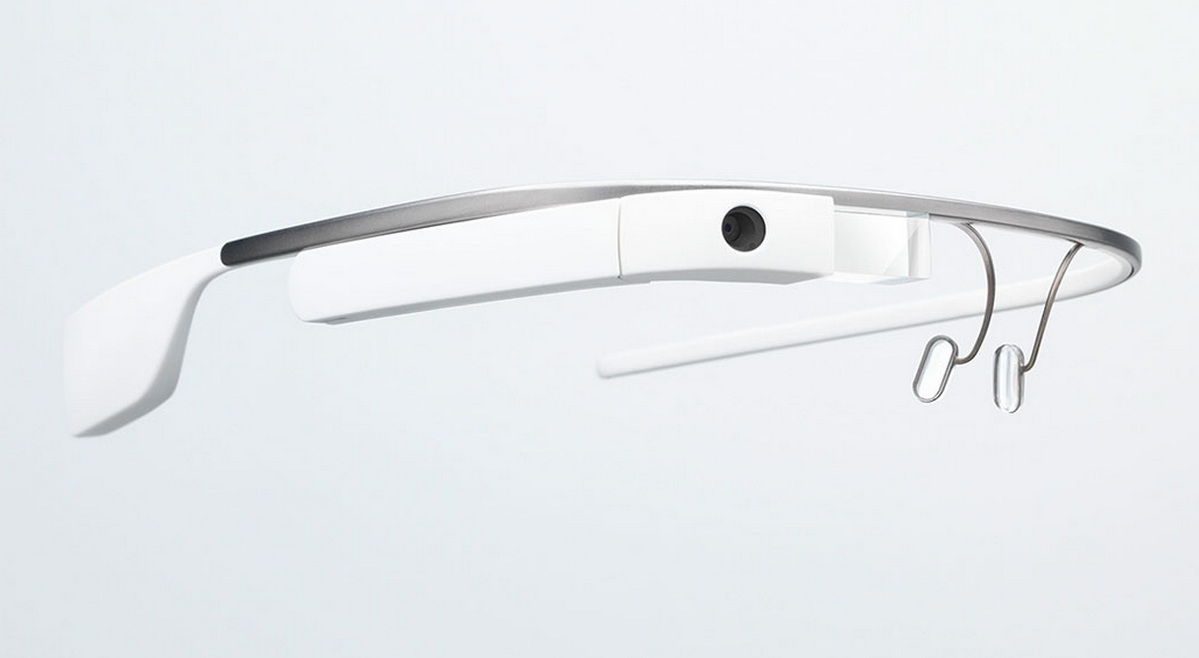

Rewind the clock to 2013. The media hype surrounding Google Glass was at a peak, and Google was well underway in its marketing campaign to generate demand before supply. From Google’s perspective, Google Glass was the next big thing: anyone (and everyone) who didn’t want to be a part of this would have to be crazy. However, at a price tag of $1,500, mainstream consumers would not have purchased Google Glass.

Glass had the potential to be highly valuable in small, niche markets, but commercialization in these markets would not have increased its value to mainstream markets.

Thus, Google chose to kill Glass and attempt to force it to evolve internally.

Glass was billed as the smartphone’s successor and hoped to disrupt that mainstream market. In 2013, 120 million smartphones were sold in the U.S.

The 4 producers of high-end smartphones accounted for 85% of this market. 149.2 million Americans owned smartphones, the average price of a smartphone was $372, and the average cost of manufacturing a smartphone was $218.19. With this information, we can offer an answer for the following question: at a price of $1,500, under what circumstances would the average user of high-end smartphones switch to Glass?

The fundamental principles of our theory of disruption relies on a simple inequality: that consumers will consider buying the new technology when the utility they get from the new technology minus the price of purchasing the new technology is at least equal to the utility minus the price of the existing technology:

Our calculations tell us that to appeal to average smartphone users, Glass would have to be 210% more valuable than smartphones are. Was such a goal achievable?

In an essay for Wired, Glass user Matt Honan wondered where Glass would be accepted in everyday life:

“I won’t wear it out to dinner, because it seems as rude as holding a phone in my hand during a meal. I won’t wear it to a bar. I won’t wear it to a movie … Again and again, I made people very uncomfortable. That made me very uncomfortable. People get angry at Glass. They get angry at you for wearing Glass.”

For the average smartphone user, what is the marginal value that Glass offers? Almost every job that Glass can complete, a smartphone can do as well. The difference is that Glass allows for an extra element of convenience. However, the marginal utility of that convenience is small, while the psychic and social cost of wearing a piece of Glass is high. For the average user, the benefits of Glass are simply not enough to outweigh the concerns. Meeting 100% of the value that smartphones create for average users will be a difficult proposition, let alone passing 200%. Before Glass can even think about disruption, it needs to improve the marginal value that it adds over smartphones considerably. Suppose for a moment that Glass was being developed separately from Google and did not have massive cash reserves to rely on. To finance continued investment in the product, Glass would have to commercialize in a smaller niche market.

Glass had and still has tremendous potential in specific markets, where apps specifically designed to augment reality have a tangible impact. A study conducted by Stanford Medical Schools and VitalMedicals found that surgeons using Glass had markedly better performance outcomes. A UK Study is using Google Glass to help patients who suffer from Parkinsons and researchers have been working with volunteers age 46-70, developing apps specifically intended to suit the needs of Parkinson patients. Speaking about the advantages that Google Glass offers over smartphones, a volunteer on the study Lynn Tearse said “with Parkinson’s, negotiating a touch screen is really difficult.” Glass has also been able to help patients when they freeze, take calls, and perform other actions.

The utility from using Glass to satisfy specialized needs is very high. At a price of $1,500, Google Glass would have to expect that niche market consumers valued Glass 315% more than they valued smartphones. Such a goal was certainly attainable.

Google faced a challenge: commercializing a product in specialized niche markets is a delicate art. To successfully do so, Google had to ensure that it developed the Glass in a way that appeals to niche consumers to sustain revenue streams and generate income for future research and development. However, developing functionality for niche consumers, does not necessarily translate into increasing the value that Glass offers to average smartphone users. This dilemma caused the ultimate demise of Glass.

To ensure that they were moving towards mainstream market viability, when Glass develops a feature that increases its value in niche markets, that feature also needs to increase the value of Glass to mainstream consumers by about 50% of the value it added for niche consumers.

Would an average smartphone user find a specialized app designed to help surgeons about half as useful as surgeons found that tool? Amidst many other benefits, a Stanford Study found that surgeons using VitalStream (an app designed to allow surgeons to use Google Glass) recognized critical desaturation 8.8 seconds faster than the control group (who didn’t wear Glass). In the operating room, 8.8 seconds can be a crucial difference between life and death. The value added for surgeons is enormous. It is hard to imagine that the average user would value this same feature 50% as much as surgeons do.

Google was faced with an inconvenient truth. While Glass had the potential to create tremendous value in niche markets, commercialization of the product in those markets would not increase Glass’s value in mainstream markets. The new dimensions of competition that Glass introduced were simply not very important to mainstream consumers. At best, Glass in 2013 was an incremental innovation.

Glass had the opportunity to shift their focus from mainstream markets to focus their efforts on a few lucrative niche markets where they could have had enormous impact. Using the revenue generated from these smaller markets, Glass could have financed further development of the product with the hope that one day, perhaps, they would discover a ways to create value for mainstream consumers.

However, Google chose not to address the needs and demands of its niche market consumers. Let us continue with our example of Glass in the operating room. Privacy and security concerns are delaying adoption of Glass by medical professionals. The device automatically uploads information to the cloud when connected to the Internet, meaning that confidential patient data could accidentally be uploaded.There is a need to prove that Glass is safe and secure for patients before the medical community will accept it. Given these deficiencies, the price tag of $1,500 is too high to warrant investment in the technology by hospitals. As one Stanford Surgeon stated:

“while $1,500 may not be much compared to an MRI machine, many hospitals recently invested in tablets, so Glass will need to provide significant value beyond what iPads can offer in order to justify a second round of tech investment.”

The Stanford study demonstrating the potential impact of Glass suggests that overcoming this proof-of-value hurdle is certainly feasible.Google could have commercialized a stripped down version of Glass in niche markets such as the operating room. Why, then, did Google decide to kill Glass instead of developing specialized versions for niche markets? The answer to this question highlights a worrisome trend amongst Silicon Valley giants. Entranced by a desire to disrupt large markets, these giants shy away from developing technologies that have a more limited scope – despite the profound impact these technologies could have in smaller communities.

With its massive supply of cash reserves, Google doesn’t need to generate revenue to fuel its research efforts. Instead, Google can finance development of Glass through other means, in the hope that one day they will internally discover a way to disrupt the market currently dominated by smartphones and Apple.

Historically speaking, this is a bad practice. When innovations are commercialized in niche markets, they develop organically. These innovations evolve in unique and unsuspected ways. These organic innovations end up changing the way people live in far more meaningful ways than those forced to evolve in a closed environment. In many ways, the fate of Glass speaks to the newfound arrogance of Silicon Valley.

Innovations that have potential in small niche markets (such as Glass) should still be developed and commercialized in the markets they can dramatically impact (such as the operating room) even if they may never be disruptive in the mass market. Entranced by a desire to disrupt, we have forgotten that innovations solve problems: no matter how big or small they are. In 2016, rumors of an enterprise version of Google Glass, for use in environments like the operating room, have begun to surface. Perhaps Google has realized its mistake. Or perhaps Google is just responding to improvement in VR technology and preparing for imminent threats. Our model demonstrates that if Google had resisted the lure of disruption, it could have released simplified versions of Glass in niche markets much earlier.

Glass head of business development Chris O’Neill said: “We are not going to launch this product until it is absolutely ready.” What this really means is that Google won’t launch Glass until they think they have a shot at disrupting the iPhone, and the smaller communities that could benefit dramatically from Glass just have to wait.